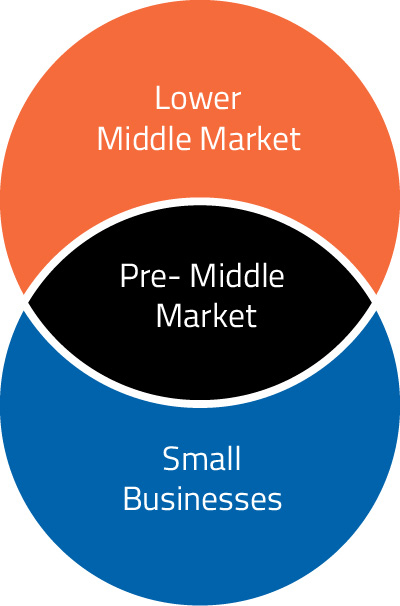

Since 1998, we have specialized in building high potential companies with EBITDA between $3 – $10 million — typically with revenues between $15 – $100 million. We seek out businesses that have what it takes: leadership in their particular industries plus management that is as ready to collaborate as we are. In fact, no one has more experience than we do building pre-middle market companies.

Hitting The Heights

YEARS OF HISTORY

TRANSACTIONS

PLATFORMS BUILT

Our Criteria

| Location: | United States |

| Industries: | Specialty Services, Niche Manufacturing, Value-Added Distribution, Food and Consumer Products |

| EBITDA: | $3 million to $10 million |

| Revenue: | $15 million to $100 million |

| Control: | Majority |

Our Specialty

- Niche or Fragmented Industries

- Ability to Differentiate

- Opportunity to Scale

- High Recurring Revenue

- Sector Tailwinds

We specialize in industries where we can build market leaders capable of breakout performance. These industries offer opportunities ripe for doing add-on acquisitions and the ability to create significant operating leverage over time. Companies such Summit Fire Protection, Gold Star Foods and Innovetive Petcare all benefited from this dynamic.

Our teams have spent their lives building a unique business that provide value to their customers. This differentiation allows our companies to stand out from the pack and forms a strong base for future growth. It’s hard to be more differentiated than Blackwood Solutions, Kronos Foods, Owen Equipment or ProClip Holdings.

Scaling doesn’t just happen. It’s the result of thousands of decisions that our teams make to improve their systems, processes and infrastructure. And once we have made these investments, it’s the success we have seen with companies like Waste Harmonics, Wedgewood Hospitality Group and Pipp Mobile Storage that drives us to build better, not just bigger, businesses.

Building a business predicated on recurring revenue provides a stable and predictable source of income for the business, allowing us and our teams to plan and make long-term investments in all types of economic cycles. Companies such as Entech Computer Services, Waste Harmonics and Minuteman Security Technologies all benefited from the “sleep at night” factor provided by recurring revenue and the stability it afforded our organizations.

Building a successful business is hard work. Doing it in a tough industry with significant headwinds is impossible. While we only expect potential, not perfection, we also look for an industry that will be a positive factor when we exit the business. Companies like Bland Landscaping, Minuteman Security Technologies, and QMI Security Solutions don’t need strong industry tailwinds to sell their stories, but it sure doesn’t hurt!

Industries

There Is No “One Size Fits All”

We’re opportunistic about the industries we work in. So long as a company meets our criteria for size, potential and leadership, we’re excited — whether the industry is manufacturing, distribution, consumer products, food or specialty services.

Over the years, our investment interests have run the gamut from security products, landscaping services, and waste management to personal-care products, veterinary care and corporate training. In fact, we’ve already invested in over 100 unique SIC codes and apply this diverse experience to each of our companies.

View our companies

Over the years, our investment interests have run the gamut from security products, landscaping services, and waste management to personal-care products, veterinary care and corporate training. In fact, we’ve already invested in over 100 unique SIC codes and apply this diverse experience to each of our companies.

View our companies

View our companies

Let's Talk Potential